Bottom Line — Life is easier when you have a solid credit history. Start building it sooner rather than later. Here’s how to do it.

If you’re working, you should be building your credit history. We don’t think ahead. One day you buy a house and realize you don’t any credit history and banks don’t trust you. Even worse, you have bad credit history. Banks can only offer you a high interest loan. You end up throwing money away on interest payments because you didn’t think ahead. That’s why I’m telling you it’s important to build a good credit history early on.

Forget credit, I’ll use cash

That’s a shortsighted approach. Tomorrow you’ll change your mind and decide to buy a house to live in with your family. You realize you can’t afford the interest payment.

You’ll want to buy a car on loan. Those interest payments will be high if you don’t have a high enough credit score. Why overpay?

Building credit while you’re employed

Should the bank provide you with a loan if you don’t have a steady income? No. It’s a high risk move from their side. They likely won’t let you open a credit card account, and if they do, it will have a low credit limit.

If you don’t have a steady salary stream, you’re considered high risk. Banks won’t raise your credit limit. They’ll barely tolerate you using their credit card. This is why the best time to build credit history is while you’re working and have a steady income.

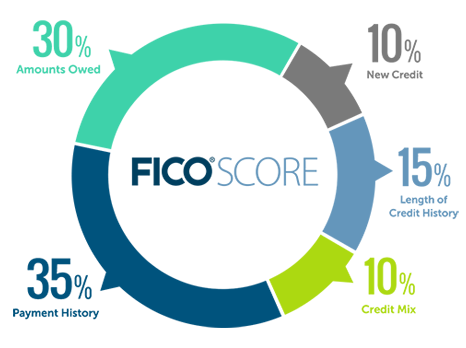

Five factors affecting credit scores

These five factors are: credit utilization (35%), payment history (35%), length of credit history (15%), new credit (10%), credit diversity (10%).

source: http://www.myfico.com/credit-education/whats-in-your-credit-score/

We’re going to focus on the first four that make up 90% of your total score. You’ll see later why the last one (credit mix) is not crucial.

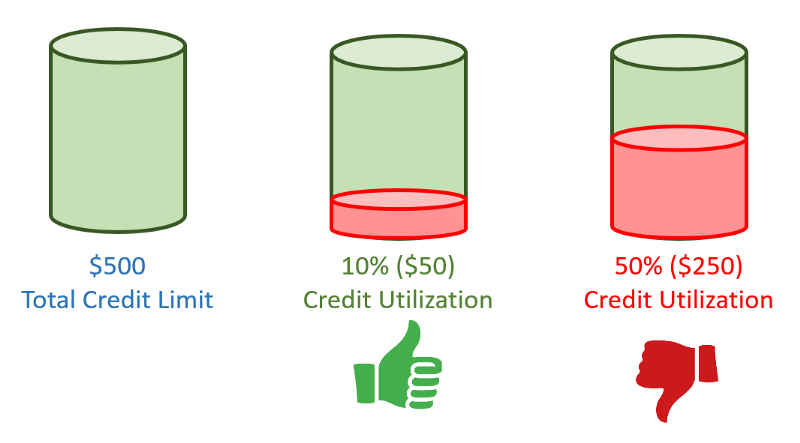

Understanding credit utilization

Credit utilization is the percentage of how much you borrow out of the total allowable credit. FICO says it’s okay to borrow between 10 and 20 percent. Let’s stay conservative and not go over 10%.

Credit utilization Examples

Let’s say your credit limit is $500. 10% of that is $50. While can borrow up to $500, it’s not a good idea because you’ll exceed the 10% threshold and your credit score will suffer for it. You should only borrow $50 or less.

Here’s another example. Your credit limit is $2000. 10% of that is $200. Don’t borrow more than $200 each month or your credit score might suffer.

Having a higher credit limit let’s you borrow more without dinging you credit score. Let’s see how we can increase that credit limit.

Increasing your credit limit

We’re going to take an active approach rather than waiting from the bank for a credit increase. While you’re employed, write down in your calendar to call your bank every 5 months. Each time you call, you’ll want a 20% increase. Let’s say you currently have a $1000 credit limit. A 20% increase would be $1200. When they’re on the phone line, speak confidently and say this:

I’d like to increase the credit limit on my credit card.

Sure, let’s see what we can do. What would you like to increase the limit to?

I’d like to increase it to $1200.

Is it okay for us to pull your credit report?

Sure.

Congratulations, we’ve increased it to $1200.

Thanks.

That’s it. In 5 months, you’ll call them again with the same message and ask for another increase to $1500 (We rounded it up).

In a couple of years, your credit limit will be higher than many folks. Your credit score will reflect that, and you’ll be able to borrow more without dinging your credit score.

Payment History

Payment history is 35% of your credit score. Payment history is where people screw up their credit history. Don’t take out more than you can pay back or else you’ll likely be late on payments. Late payments ruin your credit score.

Just by paying your credit card balance on time, you’re going to be in the green on payment history. It is a big chunk of your overall FICO score so don’t neglect it.

Length of credit history

How long you’ve had your credit history takes 15% of your FICO score. There’s not much you can do here except to realize it makes sense to start building your credit history as early as possible.

New Credit

Taking out new credit makes up for 10% of your score. Banks don’t appreciate you getting new credit cards often. Next time you go to a store and they offer you a “rewards credit card”, say no. Stick with one or two cards and you’ll go far.

Diversification of credit

It accounts for 10% of your total FICO score. I ignore this one. FICO likes to see you have a diverse type of credit with cars, houses, and other things on the line. I don’t care for that and won’t go out of my way to diversify debts. In the end, this category doesn’t matter if you take care of the other categories that make up 90% of your FICO score.

How to build credit without fees

Open a bank credit card, use it, and pay all of the balance off on time. That’s it.

Go to a big reputable bank and see if you could open a free checking account and find out what kind of credit card with what credit limit they are prepared to offer you. They need you more than you need them at this point. Make sure they have online banking so you don’t have to send checks through the mail.

If you have bills that are recurring every month such as Netflix or Amazon orders, these are great to charge on your credit card. Make sure you pay off the TOTAL balance on your credit card each month, and that you pay before the due date. Put the due date in your digital calendar and set it as a reminder each month. Have discipline and don’t be late.

Some say that you should charge items to your credit card and only pay the minimum amount each month to create a positive credit history. Don’t do that. You’ll end up paying interest fees every month. Instead, pay off the entire monthly balance and you’ll be building that positive credit history.

How long will it take

It depends on where you started from. If you started with a clean credit record, it’ll be shorter for you than if you started with a bad credit history. Just keep at it and tides will turn.

How to check your credit report / score

Don’t pay for it! There are two places that I use to check my credit report. The first is annualcreditreport.com which is a US government authorized website that allows you to check your credit report once per year for free with all three of the credit report companies. It will give you a credit report but it won’t generate a FICO credit score.

The second option to use is CreditKarma. It’s a reputable free service and they are able to pull your credit reports and generate credit scores multiple times per year. They make money by advertising credit cards and giving you loan suggestions based on your personal reports.