They say that the best things in life are free. But let’s face it, you can’t get to them if you don’t have the time. Without time, you can’t take a day off to reflect on life. That also means there’s no time for hobbies let alone, creative endeavors.

In the Declaration of Independence, we’re granted unalienable rights including life, liberty, and the pursuit of happiness. Note the order — the pursuit of happiness follows life and liberty.

The freedom to chase happiness is granted when we have liberty, and a significant aspect of liberty is the freedom of time.

Money buys the freedom of time.

But here’s the paradox: as of March 2022, 63% of Americans live paycheck to paycheck. And this isn’t just a fallout from the COVID pandemic. Even in better economic times, about 50% of people found themselves in the same predicament.

Of those 63% living paycheck to paycheck, 48% earned over $100k / year. This suggests that the problem isn’t inescapable hardship and rather a personal inability to save.

Because money can buy the freedom of time, it also buys the opportunity to pursue happiness.

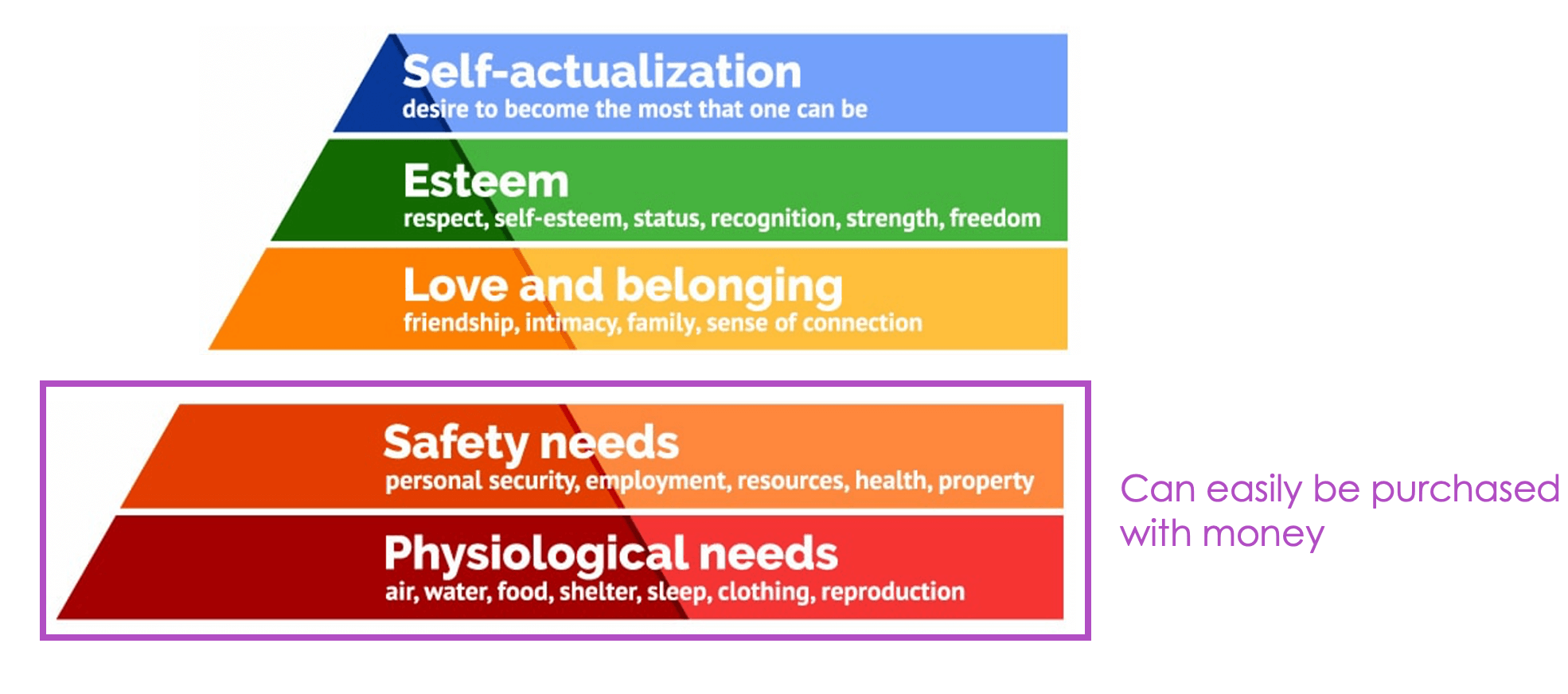

Buying the base of Maslow’s pyramid

Maslow’s Hierarchy of Needs shows human needs in a hierarchical pyramid. The needs at the bottom of the pyramid must be satisfied first before a person can move up the pyramid. Moving up the pyramid brings you closer to self-actualization and carries with it life satisfaction and feelings of happiness.

The bottom two pyramid slices — food, shelter, and the ability to live in a safe environment — can be bought with money.

Without securing the bottom two slices of the pyramid, the top three are difficult to access. Trying to access the top without the bottom is like like running a race while unintentionally carrying a 50 lb dumbbell. You might finish the race but running without the weight is easier. Money lets you offload the weight.

Most people will run the race of life carrying the weight, leaving them little time for forming relationships, following creative interests, and feeling secure that it’ll be okay.

Cash is a safety net in a storm

Life is like an ocean, subject to unpredictable weather. If you’re chronically living paycheck to paycheck without a safety net of cash, you’re on the surface of the ocean with waves smashing you left and right. You have no control. You’re left praying not to drown, hoping for calm weather that, like all things, is cyclical.

Having a safety net of cash is sitting deeper in the ocean. While the surface is pummeled by waves, the deeper you are in the ocean, the calmer it is. You have time to think and to respond rather than to panic and react.

Why it’s difficult to save

Saving money comes naturally to some people but it’s difficult to most. If it was the other way around, credit card companies wouldn’t exist because most folks wouldn’t keep a running balance on their cards.

When I was young, my dad told me that a rich man is the one who has enough.

Often, it’s our internal beliefs from childhood that skew our relationship with money. If you’re one of those 48% that earn more than enough to live but cannot save, it’s worthwhile to figure out the psychological blocks behind that and get on the path to building a safety net.

# The Power of Money: My Personal Experience

Don’t get me wrong, my intention here is not to impress you, but to impress upon you the real-life situations where money can come through and alleviate situations.

A good night’s sleep

The best side effect of having a cash safety net is sleeping peacefully at night. Mark Cuban voiced a similar opinion — I’d rather sleep well at night, I’d put it in cash.

People often warn against hoarding cash because inflation gradually erodes its value. However, investing that money in the stock market isn’t a risk-free option either. It requires time and knowledge to make informed investment decisions, and there’s always the chance you could lose money.

For me, the peace of mind that comes with having a cash safety net outweighs the minor loss to inflation. During periods of high inflation, it’s better to store your cash in a high-yield savings account to minimize the effects of inflation and still have quick access to your money.

Seizing opportunities during a crisis

The stock market lost a bunch of value when COVID hit during 2020. The economy was shutting down and fear was abound. People sold their positions and stock prices plummeted.

During the 2020 COVID crisis, people sold off their stocks due to fear and the stock market plummeted. The decline was temporary. Those with cash on hand bought companies at a deep discount and were rewarded with higher returns when the economy stabilized a year later.

Changing Careers

I was able to switch careers from a petroleum engineer to a software developer because I had a cash safety net. The financial buffer gave me time to make the change ensuring that I could survive for months if my current job fell through.

Getting laid off from work

When I started my first professional job, I was making close to six figures in the Oil and Gas industry. That income was several times more than I made as a teaching assistant at my University.

I drove an old Geo Prism to work. A few folks told me — you’re a professional now, live a little, you can afford to lease a luxury car.

Three months later, I was laid off. Goodbye income.

Luckily, I had no interest in upgrading my car. I continued living with my parents while saving most of my income.

It took 6 months to find my next stable job. Had I bought into the lifestyle race and leased a luxury car, I would have been in debt and without income.

Instead, I took my savings, paid off my student debt, and had enough to make it through several months until securing my next job.

Freedom to exit toxic work environments

I’ve been laid off and I’ve quit jobs in the past. Having a safety net of cash encourages a value for value relationship between you and your employer.

Value for value means that if there’s abuse from you, your employer has the right to fire and likewise, if there’s abuse from them, you should feel empowered to leave.

If you’re living paycheck to paycheck, it’s hard to leave a company when you’re totally dependent on that next paycheck.

That means if your job has unreasonable expectations, you’re stuck.

Protection from the justice system

Money can save your life when you end up on the wrong side of the law — guilty or not.

A friend’s experience — let’s call him Robert — made me a believer. Robert lived paycheck to paycheck — one unexpected bill away from disaster.

Robert was locked up in county jail for missing a court summons that he wasn’t aware of.

On a traffic stop, Robert was arrested and taken to a county jail on a Friday night. The bail was set to $2000. Since courts are closed on weekends, he’d have to spend the weekend in jail.

Without bail money, he was looking at spending at least two weeks in jail until the courts resolved the situation.

I bailed him out that night.

In a few weeks, the court issue was resolved and the case was dismissed.

Now imagine the consequences of being jailed for two weeks? You disappear from work and are likely fired. Landlord can’t get a hold of you? You’re evicted. This isn’t even taking into account the risk to your personal safety in jail.

Saving Strategy — thinking in terms of time

I like to think of savings in terms of time. If I were to lose my income, how much time would I have to maintain my existing lifestyle?

If you’re just starting to build a money safety net, start with baby steps. Save enough to maintain your existing lifestyle without a paycheck for a week, then several weeks, and then a few months.

Personally, I prefer a money safety net of one year.